Competitor Benchmarking: Understanding Comp Shopping To Maximise Your Sales

In the era of technology, e-commerce continues to push the boundaries of profit and opportunities worldwide. In Asia alone, the e-commerce market is estimated to surpass one trillion USD in 2021. While this creates an abundance of opportunities for brands and retailers, competition today remains a challenge in this industry as more people are scrambling to reap in the profits that e-commerce holds. More than ever before, effective comp shopping is critical to help brands stay ahead of the game.

What is comp shopping?

Comp shopping, short for comparison shopping is a methodology in keeping tabs on your competition. This usually takes place on a regular basis and is typically conducted by buyers. You can comp shop at the high level by looking at the overall performance of your competitors or drill down to monitor each competitor’s assortment, pricing, discounting and product placement strategies. As the saying goes, “keep your friends close and your enemies closer”. That is why it is imperative for comp shopping to be done at least once a month to ensure you are always in the loop of the changes in your competitors’ strategies.

How to execute effective comp shopping?

For the purpose of illustrating the tips and tricks of comp shopping, we will take a look at 2 of the fastest growing ASEAN brands, ie. Pomelo Fashion and Love, Bonito, using Competitor Benchmarking to figure out what goes on behind racks and shopping carts. From reviewing the last 6 months’ launches, we noticed that despite both brands having a common goal of dominating the Fast Fashion market in Southeast Asia, they adopt very different strategies in assortment, pricing, discounting and product placements. All of which would be further analysed below.

1. Comparing Brand performance to see where you stand in the mark

Pomelo Fashion currently has an assortment size of 5,148 products, a much larger online offering with almost 2,000 products more than Love, Bonito.

Sell-out Performance for items launched in the last 6 months

The above numbers suggest that both Pomelo Fashion and Love, Bonito have a high sell out for new launches with both brands recording a sell-out rate of 70% and above. Most of which were sold out at full price demonstrating a strong grasp of consumer demand by both brands.

High frequency and consistent launches ensure the newness of the assortment and keep customers coming back. Within the last 6 months, Pomelo Fashion, being the epitome of a fast fashion brand, has been actively launching new products across almost 20 product categories- 4 times more than Love, Bonito. This is consistent with their 12.4% rate of newness which calculates the percentage of products launched within the last 30 days over the entire assortment.

In stark contrast, Love, Bonito has only a 3.9% rate of newness, hinting at a longer-term strategy for its assortment involving higher replenishment to capitalise on their best sellers, and much lower product turnovers. This is further solidified by a higher percentage of aged stocks* (ie. 86%) recorded when compared against the 55% registered by Pomelo Fashion. Whilst high replenishment can also help a brand achieve its sales target, one must also be wary of overstocking in this fast fashion segment filled with trend-conscious consumers.

*Aged stocks are calculated based on the number of product counts aged more than 120 days with stocks currently still in-stock.

2 . How to compare assortment strategies?

The right assortment mix is important to allow brands to maximize selling opportunities. While not all product category performs equally well, betting on the right assortment mix can significantly improve sales. For example, whilst the Pants and Leggings category may not always be the best performer, it is still essential to consider stocking a limited assortment to complement an outfit. Effective comp shopping can help brands spot gaps in the market and adjust their assortment mix accordingly.

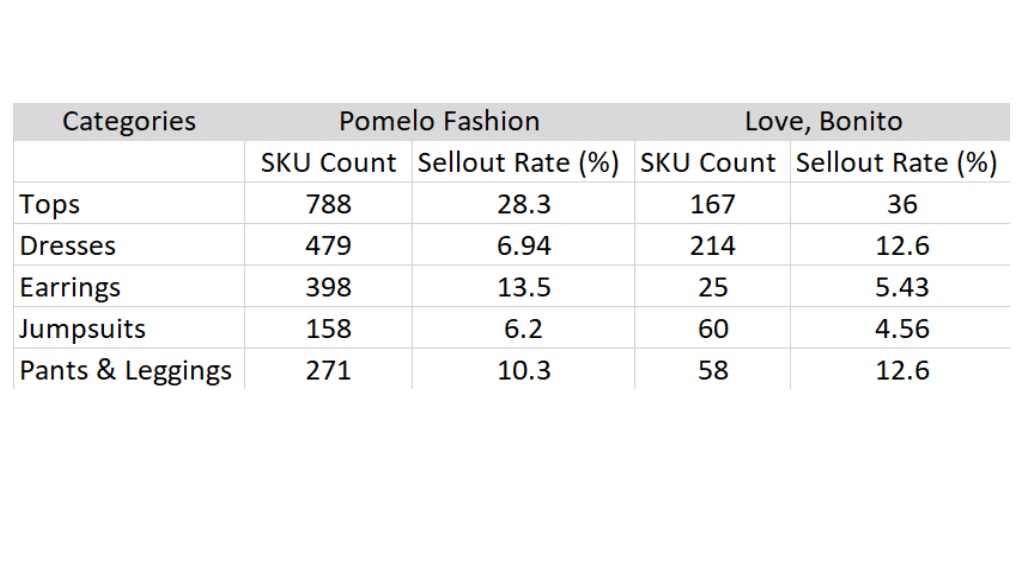

The above compilation benchmarks the top categories within Pomelo Fashion against Love, Bonito, showcasing their sellout rates against their overall stock count for each category. The Tops category leads the assortment for Pomelo Fashion with both the highest product count and category sell-out rate of 28.3%, an indicator of consistently meeting growing demands for this category.

On the other hand, Love, Bonito’s Tops category, while met with the highest sell out rate is not the highest category contributor. High sell out rates in low contributing categories may suggest a possible gap in the market for the retailer to fill. Conversely, for categories with low sell out rates such as Jumpsuits, this can be an indicator of low demand and raise a red flag for brands to revisit their assortment and look at the need to initiate an early clearance.

3. How to compare pricing strategies?

The pricing strategy for both brands varies with Pomelo Fashion adopting a wider price spread with a 20% lower entry point compared to Love, Bonito with a price point concentration between USD21 – USD35.

Even more, telling is the price point which each brand invests in. Pomelo Fashion invests heavily in price points up to USD30 while Love, Bonito is slightly more premium with higher investment in the USD30 – USD40 price band and minimal products below USD20. A higher entry point allows brands more room for discounting and maximise on margins but also runs the risk of driving consumers to their competitors.

At the end, it all falls back on the brand’s DNA. If the brand started at a lower entry point, a gradual scale is usually recommended to encourage consumers to increase their spend and at the same time expand market reach.

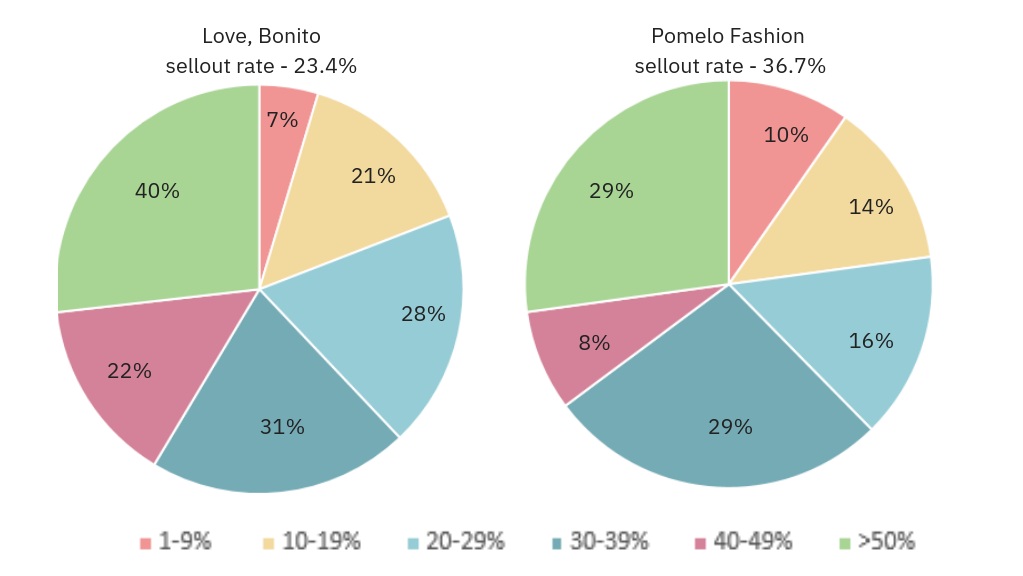

Pomelo Fashion currently has only 26.9% of its assortment on discount, slightly lower than Love, Bonito (ie. 31.7%). Of which, the former has approximately 29% contributed from discounts of 50% and more with an average sell-out rate for discounted items at 36.7%. In comparison, Love, Bonito has only 40% of its assortment with discounts of 50% and more but with a much lower average sell-out rate of 23.4%.

The data shown suggests whilst Love, Bonito has higher % of products on discount, their online consumers are less price sensitive and discount centric. In a similar situation, a brand can look into stocking at multi-label discounting sites or sell offline as an alternative clearance strategy.

On the other hand, deep discounting seems to be a good clearance strategy for Pomelo Fashion. In view that they adopt a high launch frequency, fast stock clearances would ensure healthy inventory levels.

5 . How to determine product placement strategies?

With e-commerce taking over traditional brick and mortar, brands now have abundant distribution channels through not only their own website but also multi-label retailers. Let’s have a look at how Pomelo Fashion and Love, Bonito plan their product placement strategies.

As for Love, Bonito, in addition to stocking on their own website and on Zalora, they also stock with FashionValet, a multi-label retailer that focuses on modest fashion. This strategy was likely executed with the intention of targeting different demographics. Unlike the high sell-out performance on their own website, the assortments distributed on Zalora however was met with a lower sell out rate and high discounting, a possible indicator that stocking on Zalora is a means to a clearance strategy.

Summary

Comp shopping allows for a clearer understanding of your competitive landscape and how to leverage on this knowledge to build impactful strategies.

Pomelo Fashion and Love, Bonito have very distinct strategies on how they operate and sell with both brands demonstrating a deep understanding of their consumer demand. The former moves quickly both in terms of launches and speed to sell out and relies on deep discounting for clearance. Love, Bonito, on the other hand, starts with a higher price point and prefers to capitalise on their best sellers with higher replenishments. While focusing on key strength is by no means a business mistake, proper assortment planning teamed with both internal and external data is a crucial step to avoid overstocking.

The many benefits of comp shopping allow you to…

#1 Spot gaps in the market

#2 Understand your competitors’ grasp of their consumer demand

#3 Observe critical success factors

#4 Identify product placement opportunities to expand market reach

#5 Source for alternative clearance strategies

#6 Map where your brand stands amongst the competition

#7 Leverage on competitors’ past data to formulate growth strategies

Ultimately, the aim of comp shopping is to reduce uncertainties and avoid mistakes that could cause a detrimental ripple effect by using solid data that offers precise results to help your brand grow to new heights and reach its fullest potential.